Let’s conquer your

financial goals.

Ready to start Stashing? It only takes 2 minutes to get up and running.

Get started

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed tincidunt sodales lectus, et sollicitudin arcu tempus et. Mauris mattis justo id augue ultrices, nec tincidunt ligula porta. Pellentesque aliquam condimentum mi in egestas. Praesent lobortis ligula ut sem scelerisque feugiat. Cras ut nisi ligula. Nunc massa nunc, tincidunt eu lectus in, malesuada porttitor ligula. Maecenas convallis vel mauris et viverra. Praesent molestie mollis interdum. Quisque lobortis nec diam a eleifend. Proin mi est, tempor quis tortor ut, ullamcorper aliquam libero. In a mi eget eros iaculis scelerisque.

what

here’s a box

here’s another box

Start investing with as little as $5 with our flexible investing and retirement accounts.

Browse investments →Get a no-hidden-fees1 bank account2 and the debit card that earns stock when you spend3.

Learn more →

Take a hands-off approach with our automatic saving and investing tools.

Everything in Stash Growth.

Plus, you’ll also get:

Each plan includes Financial Counseling services which is impersonal investment advice, as it relates to guides, reports, and education material about investing and financial planning. Each plan includes the option to open a brokerage account and a bank account. The subscription fee is due if a client is receiving Financial Counseling Services regardless of whether or not a client chooses to open and/or use a brokerage account. In order to obtain personalized investment advice, clients are required to complete the suitability questionnaire during registration, must be approved from an account verification perspective and open a brokerage account. Click here for more details.

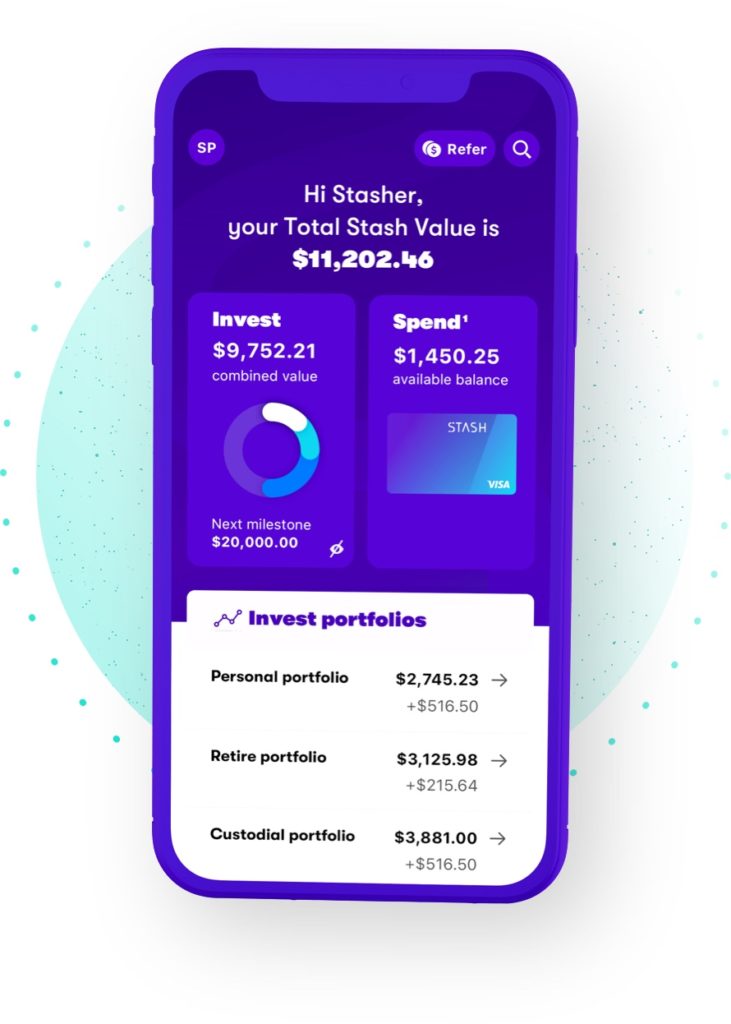

Stash is a personal finance app that can help anyone improve their financial life.

From budgeting to saving for retirement, Stash features banking, investing, and advice all in one app. We’ve helped millions of Americans reach their financial goals–all for one low monthly price.

Stash is on a mission to empower regular Americans to build wealth. We believe every financial decision can be an investment in your future—that’s why our tools and products are designed to help people achieve greater financial freedom.

Unlike a lot of other financial companies, we’re here to help build healthy financial habits, hit money goals, and remove long-standing barriers to building wealth.

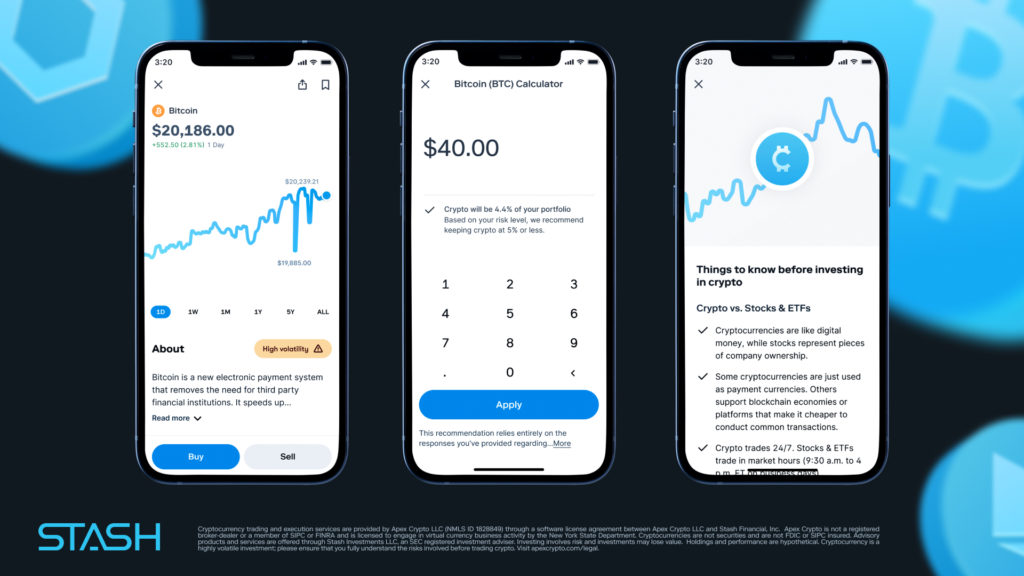

By giving Stashers access to simple, affordable investing and unlimited financial education, we remove what we consider to be the two biggest barriers stopping everyday Americans from building wealth: inaccessibility and lack of financial literacy.

In their place, we’ve created a clear path to better financial futures for all Americans.

We offer two affordable monthly plans, Stash Growth and Stash+.

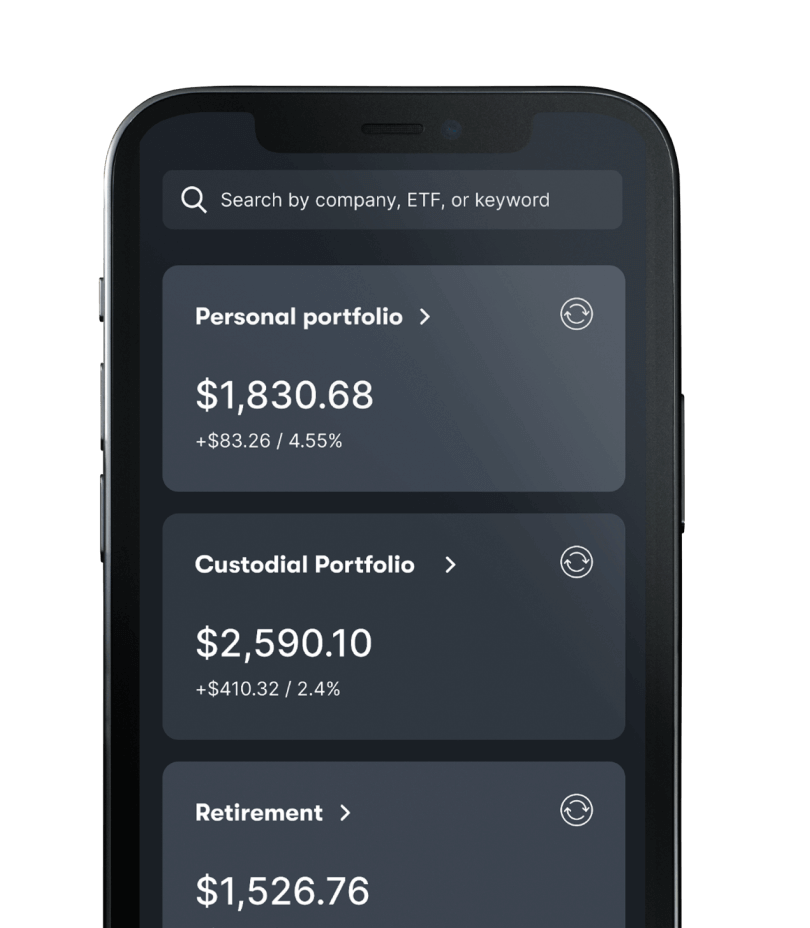

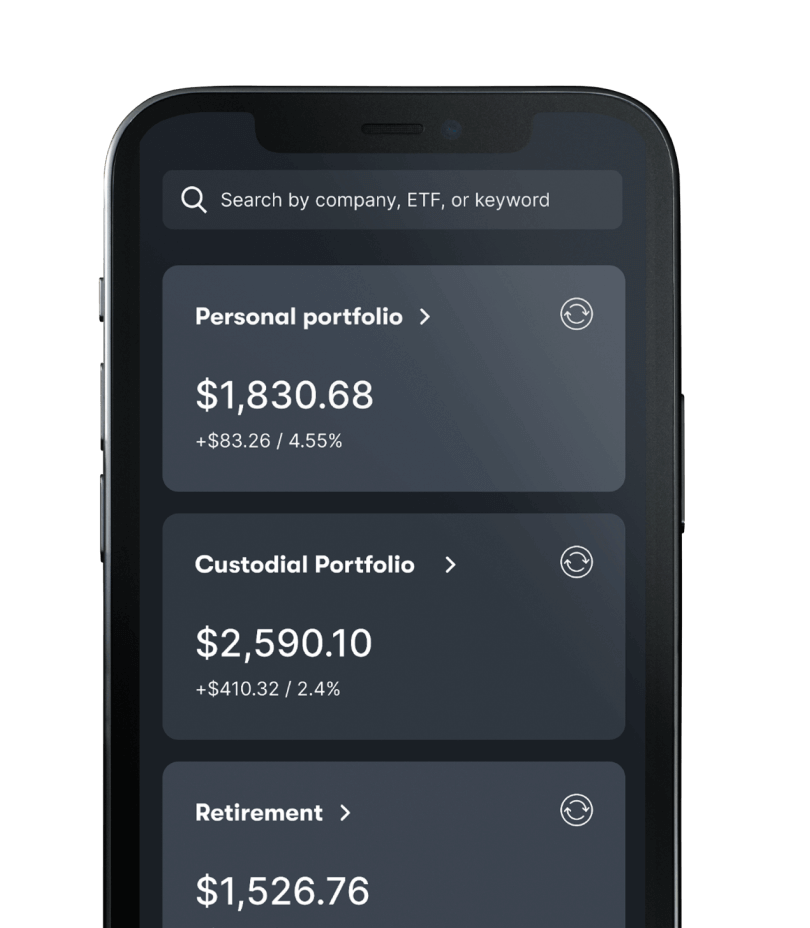

Stash Growth costs $3/month. Ideal for first-time investors, this plan includes a personal investment account, the Stock-Back® Card, and saving tools. You’ll also get personalized advice geared toward your goals, along with a Roth or Traditional retirement account (IRA),4 an automated investing account (Smart Portfolio), and $1,000 of life insurance coverage through Avibra.‡

Stash+ costs $9/month. It’s a great choice for savvy wealth builders and debit card spenders. It includes a personal investment account, and a Stock-Back® Card that earns double stock,1 Stash+ also gives you access to investment accounts for kids5, a Roth IRA or Traditional IRA retirement account, and an automated investing account (Smart Portfolio). That’s in addition to personalized advice, an exclusive monthly market insights report, savings tools, and $10,000 of life insurance coverage through Avibra.‡

Each Stash subscription is built for long-term investing and wealth creation. Individual plans are designed to address a range of different financial needs and goals.

Stash Growth was made for beginners and includes all of our wealth-building basics, including access to a personal investing account, a retirement account, an automated investing account (the Smart Portfolio), and the Stock-Back® Card. It’s a good starting point if you’re new to saving and investing.

Stash+ is our premium plan offering, and it includes every tool, feature, and account type that we offer. Highlights include investment accounts for children,5 a Stock-Back® Card that earns double stock,1 and an extra $10,000 of life insurance coverage through Avibra.‡ If you’re a debit card spender, have kids, or simply want to maximize the potential of your money on Stash, this plan could be right for you.

Yes. You can upgrade, downgrade, or cancel your Stash subscription plan at any time.‡ We understand that as life changes, your needs may change as well.

This has some value

This probs doesn’t