The Stash Way is our simple but complete financial framework. It’s partially based on the nonprofit Financial Health Network’s measurements for financial health. Generally, it can be used as a checklist to get—and stay—financially healthy.

✅ Spend less than you earn.

✅ Pay bills on time.

✅ Save for the unexpected.

✅ Invest regularly.

✅ Diversify and think long-term.

✅ Insure your assets and yourself.

When it comes to investing, the Stash Way has two things to say.

- Invest regularly.

- Diversify and think long-term.

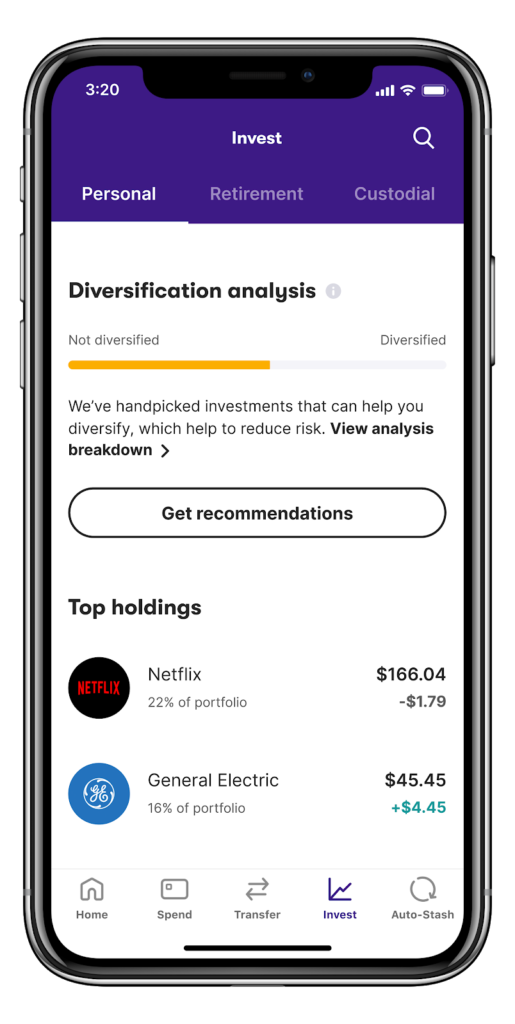

We’ve long offered the ability to invest regularly with Set Schedule. Now we’re helping you diversify for the long-term with Diversification Analysis.

What is Diversification Analysis?

Currently only offered for personal portfolios, the analysis can analyze your holdings and give you a score and identify ways you can improve your diversification. A well-diversified portfolio consists of many different types of investments that are each exposed to different market factors and risks. And a properly diversified portfolio can have considerably less risk than a non-diversified portfolio, though, of course, all investing involves risk.

How does it work?

Three pieces of information go into calculating the analysis.

- Your risk profile

- Your target allocation mix (the ideal ratio of the 4 asset classes for your risk level)

- Your current portfolio holdings

First, we look at your current underlying holdings. We calculate, by percentage, how exposed your portfolio is to each of these four asset classes: U.S. equities, foreign companies, emerging market equities, and bonds.

Next, we compare your portfolio’s allocation percentages to that of a well-diversified portfolio for your risk level. You’ll get a score based on how close or far away you are from attaining that ideal allocation percentage.

Lastly, we provide investment recommendations that can help you fill the gaps and get you closer to your allocation goals.

How are the recommendations generated?

The investment team at Stash has hand-selected ETFs for each asset class based on many different criteria. All of these ETFs can be suitable for investors at all risk levels and can be broadly exposed within their asset class designation.

How do I use it?

Simple. Make sure to update your app. Then, just tap the Invest tab and scroll down to your diversification analysis.

You can learn even more about Diversification Analysis here. Happy Stashing!

Disclosures

Stash through the “Diversification Analysis” feature does not rebalance portfolios or otherwise manage the Personal Portfolio Account for Clients on a discretionary basis. Each Client is solely responsible for implementing any such advice. This investment recommendation relies entirely on the responses you’ve provided regarding your risk tolerance. Stash does not verify the completeness or accuracy of such information. Investing involves risk, including possible loss of principal. No asset allocation is a guarantee against loss of principal. There can be no assurance that an investment strategy based on the tools will be successful. Diversification and asset allocation may not protect against market risk or loss of principal. This information should not be relied upon as research. Carefully consider any ETF’s investment objectives, risk factors and charges and expenses before investing. This and other information can be found in the ETF’s prospectus which may be obtained by visiting the ETF’s prospectus pages. Carefully review and consider the information available on the Stash App about each investment recommendation, in any applicable ETF prospectus, and in any applicable public company filing or report before making any investment decision. These investment recommendations are constructed to provide clients with explicit guidance on how to allocate to a globally diversified set of investments for the purposes of long-term investing. Clients make contributions to their Personal Portfolio account and are responsible for directing purchases and sales of specific investments. For clarity, while Stash provides investment recommendations to Clients, Stash does not have authority to execute its investment recommendations on behalf of any Client without such Client’s consent and approval of each specific transaction through the Personal Portfolio Invest account.

The Diversification Analysis is based on a Client’s portfolio composition compared to a suggested allocation. The Diversification Analysis calculates the Client’s overall portfolio diversification and is used to reduce risk by encouraging the Client to diversify further. The calculation is performed by assessing the Client’s portfolio holdings and grading each asset held by its underlying exposures. The asset is graded by qualities such as asset type, regional exposure, and percentage allocation within the portfolio. For each risk profile available on Stash, a desired portfolio allocation is created by the Stash Investment Committee. The desired allocation is used to compare to the Client’s portfolio in efforts to provide advice on how to improve diversification.