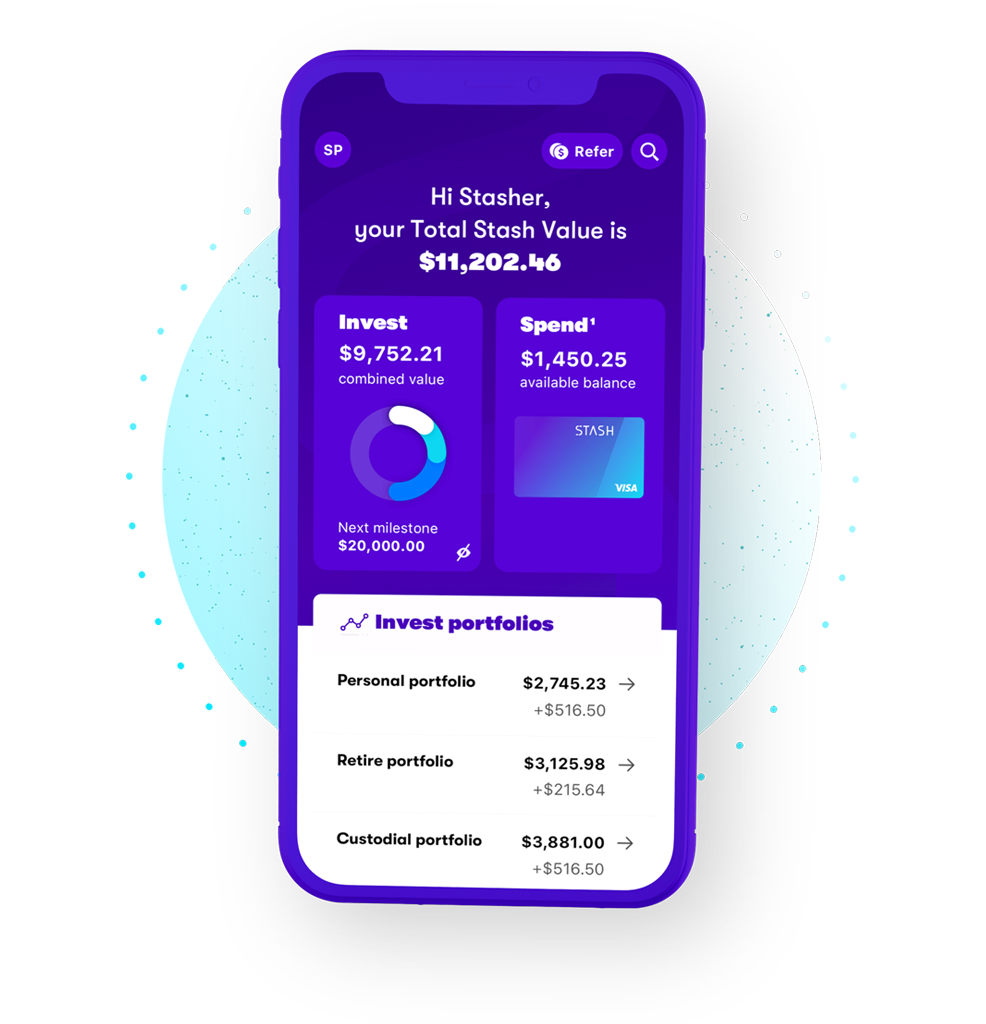

Invest in the stock market with just $1

Anyone can start building wealth on Stash. Invest, bank, and save, all on one simple app.

One app. All your money needs.

Invest in today

(and tomorrow).

Start investing with as little as $1 with our flexible investing and retirement accounts.

Browse investments →Spend and earn, smarter.

Get a no-hidden-fees1 bank account2 and the debit card that earns stock when you spend3.

Learn more →

Build wealth automatically.

Take a hands-off approach with our automatic saving and investing tools.

Learn investing in less than 5 minutes.

How to invest – The Stash Way.

To help you get started, we’ve developed a simple, beginner-friendly investing philosophy called The Stash Way.

How to Get Started Buying Stocks.

Don’t know where to begin? Let’s dive into some basic questions and answers about how to get started investing in stocks.

How Investing Through Volatile Markets Can Increase Your Portfolio.

Curious to see what your investing portfolio might have looked like if you could have used Set Schedule from 2008 until March 2020?