Be a trailblazer.

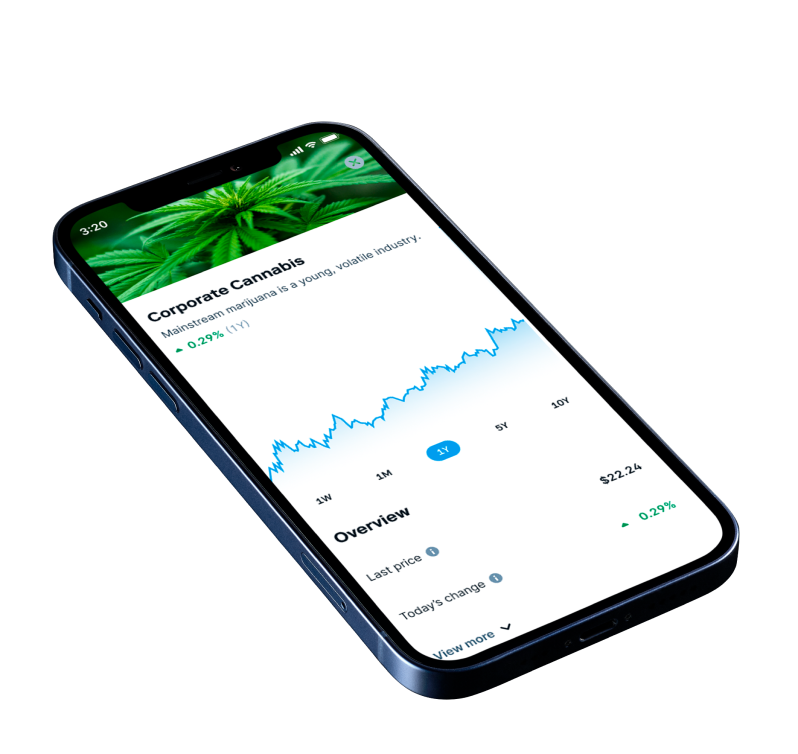

Invest in the legal cannabis industry. Start with $5.

To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account. One Month promo offer subject to T&Cs available in registration.

*Terms and Conditions

Stash does not endorse the illegal use of narcotics.

Here’s how we set you up for

investing success.

Invest anywhere.

Buy, sell, and manage your investments online or from our easy-to-use app.

Recurring investments.

Just tell us how much and how often to auto-invest—we’ll do the rest.

Dividend reinvestment.

Invest in companies or funds that pay dividends and we can instantly reinvest them for you.

The Stock-Back® Card.1

Get the debit card that rewards you with bonus stock.

Personalized guidance.

Get advice on how to start investing and recommendations on diversifying your portfolio.

Stock Round-Ups.13

Automatically turn your spare change into real wealth.

Frequently asked questions

What is Stash?

Stash is a personal finance app that can help anyone improve their financial life.

From budgeting to saving for retirement, Stash features banking, investing, and advice all in one app. We’ve helped millions of Americans reach their financial goals–all for one low monthly price.

How much does Stash cost?

We offer two affordable monthly plans, Stash Growth and Stash+.

Stash Growth costs $3/month. Ideal for first-time investors, this plan includes a personal investment account, the Stock-Back® Card, and saving tools. You’ll also get personalized advice geared toward your goals, along with a Roth or Traditional retirement account (IRA),4 an automated investing account (Smart Portfolio), and $1,000 of life insurance coverage through Avibra.‡

Stash+ costs $9/month. It’s a great choice for savvy wealth builders and debit card spenders. It includes a personal investment account, and a Stock-Back® Card that earns double stock,1 Stash+ also gives you access to investment accounts for kids5, a Roth IRA or Traditional IRA retirement account, and an automated investing account (Smart Portfolio). That’s in addition to personalized advice, an exclusive monthly market insights report, savings tools, and $10,000 of life insurance coverage through Avibra.‡

What is Stash’s mission?

Stash is on a mission to empower regular Americans to build wealth. We believe every financial decision can be an investment in your future—that’s why our tools and products are designed to help people achieve greater financial freedom.

Unlike a lot of other financial companies, we’re here to help build healthy financial habits, hit money goals, and remove long-standing barriers to building wealth.

By giving Stashers access to simple, affordable investing and unlimited financial education, we remove what we consider to be the two biggest barriers stopping everyday Americans from building wealth: inaccessibility and lack of financial literacy.

In their place, we’ve created a clear path to better financial futures for all Americans.