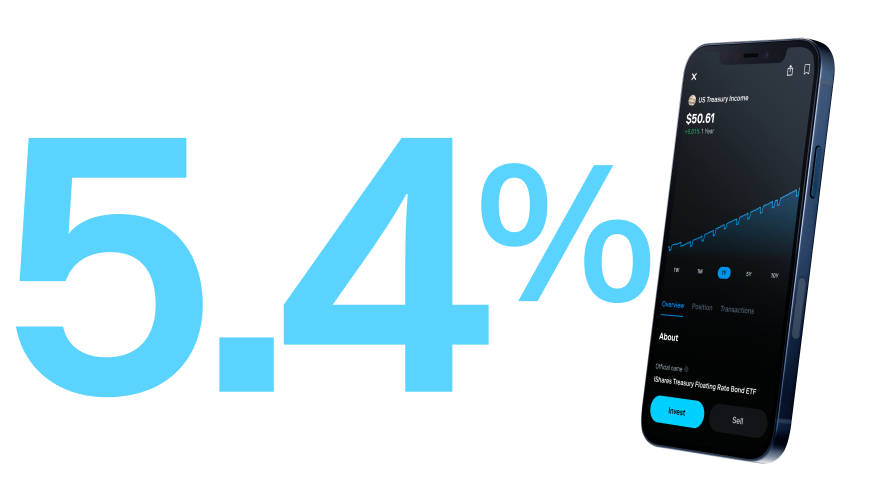

Put your money to work

Build your emergency fund now. Invest in US Treasury Income and you can earn 11X the national savings rate.*

*Source: National Deposit Rate as of January 16th 2024.

What is US Treasury Income?

Earn a higher yield.

US Treasury Income (TFLO) delivers an annual dividend yield of over 5.0%—with dividend payouts every month.** Plus, it’s backed by one of the world’s lowest risk borrowers, the US government.

Earn Extra Cash.

US Treasury Income is an exchange-traded fund (ETF) that contains short-term loans to the US government; the investment pays a dividend based on market interest rates. That can mean extra cash in your pocket.

Do more with your money.

US Treasury Income contains bonds that are often exempt from state and local taxes, allowing you to hold on to more of your money.

**Securities with floating or variable interest rates may decline in value if their coupon rates do not keep pace with comparable market interest rates. All investments are subject to risk and may lose value. The current rate is dynamic and based on the 30-day SEC yield as of 02/6/24. Click here for more details.

Build wealth, The Stash Way®

When investing, remember to practice The Stash Way®—invest regularly, diversify, and hold investments for the long term.

Why invest with Stash

Investing

Invest in fractional shares of thousands of stocks and ETFs.

Saving

Get closer to your financial goals with easy-to-use tools like stock round-ups and goals.6

The Stock-Back® Card.1

Get the debit card that invests in you every time you spend—and earn up to 3% in stock on every swipe.1

Advice

We can guide you as you build wealth for the long term.

Banking

Protect your money from overdraft and other hidden fees.2

Insurance

Stash includes complimentary life insurance offered by Avibra.‡

Frequently asked questions

What is Stash?

Stash is a personal finance app that can help anyone improve their financial life.

From budgeting to saving for retirement, Stash features banking, investing, and advice all in one app. We’ve helped millions of Americans reach their financial goals–all for one low monthly price.

How much does Stash cost?

We offer two affordable monthly plans, Stash Growth and Stash+.

Stash Growth costs $3/month. Ideal for first-time investors, this plan includes a personal investment account, the Stock-Back® Card, and saving tools. You’ll also get personalized advice geared toward your goals, along with a Roth or Traditional retirement account (IRA),4 an automated investing account (Smart Portfolio), and $1,000 of life insurance coverage through Avibra.‡

Stash+ costs $9/month. It’s a great choice for savvy wealth builders and debit card spenders. It includes a personal investment account, and a Stock-Back® Card that earns double stock,1 Stash+ also gives you access to investment accounts for kids5, a Roth IRA or Traditional IRA retirement account, and an automated investing account (Smart Portfolio). That’s in addition to personalized advice, an exclusive monthly market insights report, savings tools, and $10,000 of life insurance coverage through Avibra.‡

What is Stash’s mission?

Stash is on a mission to empower regular Americans to build wealth. We believe every financial decision can be an investment in your future—that’s why our tools and products are designed to help people achieve greater financial freedom.

Unlike a lot of other financial companies, we’re here to help build healthy financial habits, hit money goals, and remove long-standing barriers to building wealth.

By giving Stashers access to simple, affordable investing and unlimited financial education, we remove what we consider to be the two biggest barriers stopping everyday Americans from building wealth: inaccessibility and lack of financial literacy.

In their place, we’ve created a clear path to better financial futures for all Americans.