Stash, the investing app that empowers Americans to invest and achieve their financial goals, today announced the release of a new annual survey that reveals how 2,000 self-identified ‘hardworking’ Americans feel about their financial wellbeing and future. Conducted in partnership with third-party analytics firm Prodege, it’s Stash’s first and only survey to look specifically at middle- and lower-income Americans who work full- or part-time and identify as self-made. It uncovers new insights into the frequency that America’s working class thinks about money; their perceptions on the state of the U.S. economy; and the group’s optimism about the future.

“Millions of consumers work day in and day out to achieve financial stability, and with higher prices lingering for groceries, gas, and housing, it’s no surprise that money remains a top concern for Americans this year,” says Liza Landsman, CEO of Stash. “Stash ensures that our customers feel confident about investing, and that their money works just as hard as they do every day. The findings highlight hardworking Americans’ resilience and confidence in the future, which reinforces why Stash exists—to help people look forward and invest for their goals.”

For this survey, hardworking Americans are defined as working at least 30 hours a week, with an income between $50K to $150K, and who self-identify as ‘hard-working,’ ‘industrious,’ ‘ambitious,’ and/or ‘self-made.’ The respondent group reflects the U.S. Census.

The top findings from Stash’s Hardworking Americans survey:

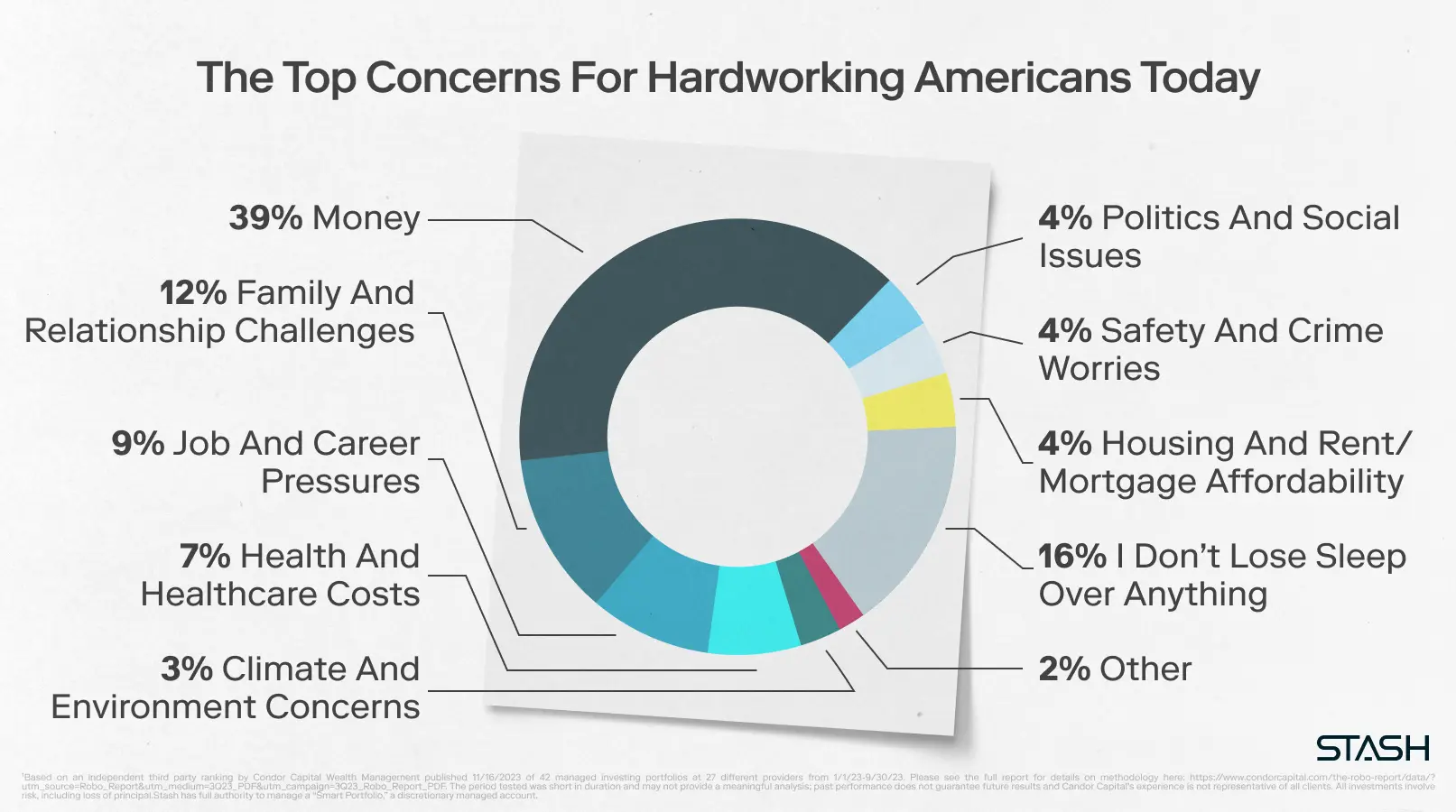

- Despite social and political issues, money is the highest concern for hardworking Americans (58% agree).

- Survey responses were collected through the first two weeks of October 2023, during which the U.S. Congress had no House Speaker and the Israel-Gaza conflict erupted. Even amidst this unsettling moment in history, money remained the highest-selected top concern.

- Only 4% of survey respondents said that political and social issues are a top concern, and just 3% chose climate change.

- 39% chose money as the ‘top’ worry.

- Despite the strength of the U.S. economy, hardworking Americans are concerned about the current financial environment.

- 23% of respondents are highly concerned about the U.S. economy, in line with other recent polls.

- Only 35% of all respondents believe that the economy will improve in the next few months.

- Gen X is the most pessimistic generation. While 57% of Millennials are pessimistic that the economy will improve, 71% of Gen X respondents feel the same way.

- Younger generations of hardworking Americans feel optimistic about their financial futures.

- 71% of hardworking Millennials believe their kids will be better off than they are.

- 67% of hardworking Millennials and 68% of Gen Z respondents think the future is brighter than the past. Comparatively, only 46% of Baby Boomers and 51% of Gen X feel the same.

- 46% of Millennials are confident they will achieve all of their financial goals. 30% of them want more than $100,000 set aside to feel secure.

- A mere 2% of respondents across every generation feel ill-prepared for the hardships of today.

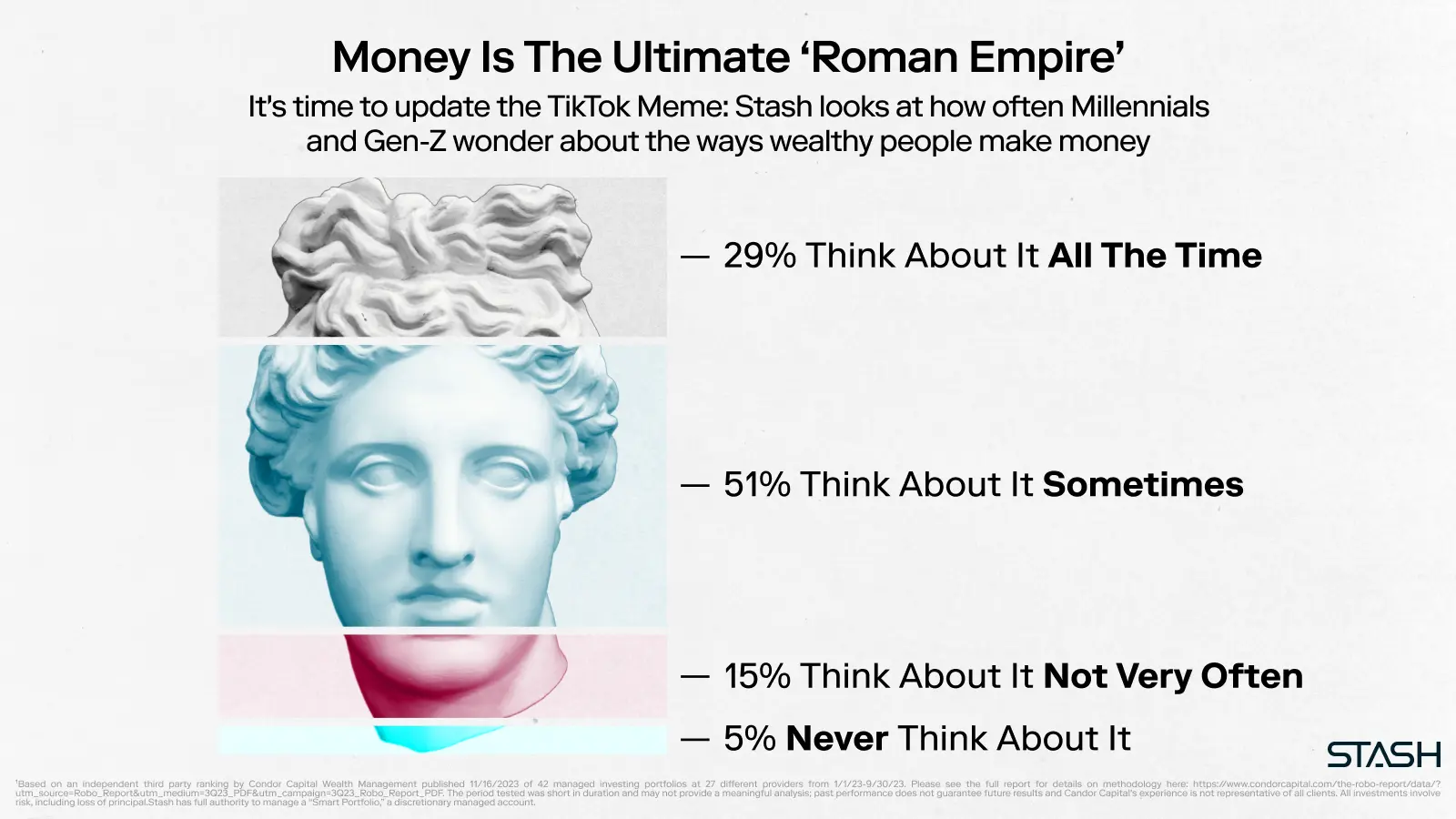

- Hardworking Americans want to understand more about how wealthy people make money.

- Nationally, the wealthiest 1% of Americans make more than $652,000 a year on average4.

- Nearly all (89%) of survey respondents think about how wealthy people make their money at some point in time.

- It’s an even bigger focus for Millennials and Gen Z: 95% of that group think about how wealthy people make money at some point.

- And almost a third of that group are even more obsessive: 29% of Millennial and Gen Z respondents say they think about how wealthy people make their money all the time, in comparison to just 11% of older Americans (Gen X and Boomers).

- Financial literacy is improving, although some hardworking Americans are still distrustful of the market and what they see on social media.

- One fifth (20%) of hardworking Americans think the bulk of their savings should be all cash, forgoing thousands in savings from compound interest.

- The increase of financial technology tools has brought this number down from a 2015 survey reporting 43% of Americans keep their savings in cash5.

- 95% of all respondents believe that people lie about their wealth on social media.

- Savings and retirement priorities differ by gender and generation.

- Millennials and Gen Z’s top priority is building an emergency fund, while Gen X’s top priority is saving for retirement.

- Despite soaring prices and interest rates, buying a home is still top priority for a fifth (19%) of hardworking Millennials and Gen Z. Currently, 53% of respondents under 45 are either actively working towards buying a house, or wanting to but feel that it’s out of reach.

- Both Millennials and Gen Z are more open to talking to others if they find themselves in a challenging financial situation. Younger generations are nearly 2x as likely (or more) to speak with friends and family than their Boomer and Gen X counterparts.

- Financial equity is still a gender issue, with half of hardworking men reporting that they have some type of traditional investing accounts, while only 30% of hardworking women say the same.

- New government policies are having an impact: 60% of hardworking Millennials and Gen Z agree that student loan repayment policies have made a difference in their lives.

Methodology

For this study Stash, in partnership with Prodege, surveyed 2,000 middle-income Americans who self-identified as being “hardworking”. All respondents were working full or part-time and indicated that their household income was between $50,000 and $150,000 per year. Respondents were also required to indicate that they work a minimum of 30 hours a week and self-identify as “hardworking”, by selecting one of the following words: Hardworking, Industrious, Ambitious or Self-made. Respondents were asked about their financial goals, challenges, financial needs and perceptions. The sample was quota-managed to match the U.S. Census for middle-income Americans on Age, Gender, Race/Ethnicity, Region, Income, and Education. This survey was fielded in October 2023 by Stash’s internal research team in partnership with Prodege. Stash was not identified as the sponsor of this study. The results of this survey may not be representative of all hardworking, middle-income Americans.

Audience details: 2,000 Hardworking* Middle-Income** Americans who make between $50,000-$150,000/year

*Hardworking: Employed full or part-time, working at least 35 hours/week, and self-identifying as “Hardworking” or equivalent.

**Middle-income is defined as having a household income between $50,000 and $150,000/year

About Stash

Stash is an investing app dedicated to empowering people to invest and build better lives. Stash’s plans—starting at just $3 a month—unlock access to a suite of simple, automated solutions designed to help people find security and peace of mind through investing. In 2023, the company announced the appointment of Liza Landsman as CEO, a $40M fundraise, and its Smart Portfolio was named as the top-performing overall robo-advisor by Condor Capital1. Stash counts 2M active subscribers who have set aside nearly $3B thanks to regular, automatic deposits of $33 on average2. Stashers are 15% more financially literate than the average American3, and rely on Stash for timely education, expert advice, and clear next steps to help them grow their money and achieve lifelong goals.

1Based on an independent third party ranking by Condor Capital Wealth Management published 11/16/2023 of 42 managed investing portfolios at 27 different providers from 1/1/23-9/30/23. Please see the full report for details on methodology. The period tested was short in duration and may not provide a meaningful analysis; past performance does not guarantee future results and Candor Capital’s experience is not representative of all clients. All investments involve risk, including loss of principal.

Stash has full authority to manage a “Smart Portfolio,” a discretionary managed account.

2This calculation is the average transfer amount via Auto Stash as of August 2022. This calculation includes transfers completed through Auto Stash for taxable brokerage accounts, custodial accounts, and IRAs. This calculation does not take withdrawals into consideration.

3Based on surveys conducted online within the United States by Stash using SurveyMonkey technology in April 2021 and May 2022. The 2022 surveys were completed by 1,256 non-Stashers and 1,006 Stash customers. “Financial literacy” is determined and defined by the percent of correct answers to a series of financial questions by respondents, on average. Users were grouped into buckets by the number of months using Stash, then the average scores were calculated for each group, and the 12-month moving average was plotted to show the clear trend between tenure and score.

4Source: SmartAsset, 2023

5Source: American Express Spending and Savings Tracker, 2015