Stash does banking differently. Unlike traditional banks, we’re focused on helping our customers reach their money goals. As a member of the Financial Health Network, we’ve taken their definition of financial security and used it to inform our banking philosophy. We’ve boiled it down into three key aims:

- Spend less than you earn.

- Pay all of your bills on time.

- Save more of your money.

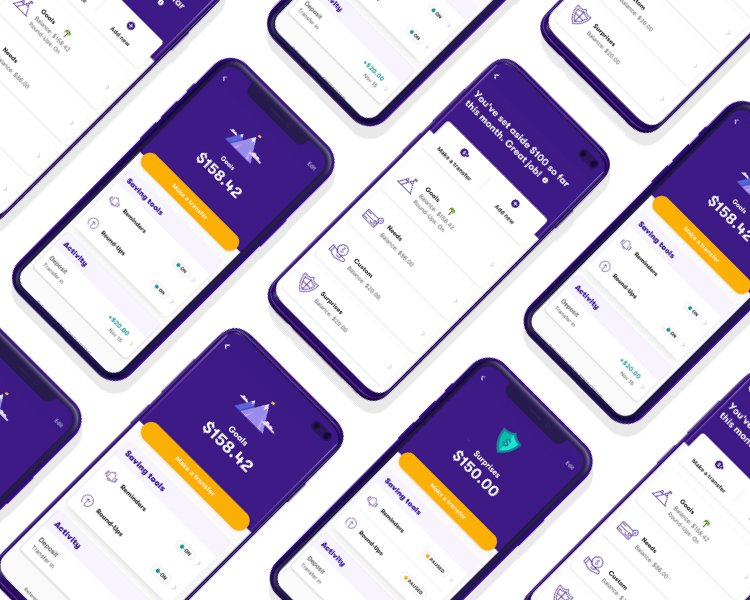

This philosophy might seem simple enough, but many people struggle to achieve it. Time and time again, our customers have asked us to find more ways to help them make progress. Our new partitions feature is our first take on that request, with much more to come.

The Research Process

We conducted surveys with thousands of Stashers, asking them about their saving and budgeting strategies. Along the way, we turned up some key pieces of information:

- Many of the people that come to Stash for investing actually need to establish financial security as well. This means they should focus on eliminating debt, paying bills on time, and maintaining a budget.

- Many Stashers are already partitioning their money themselves in some way. Some use physical envelopes to separate and allocate their cash, while others create multiple bank accounts at various banks to help create that organization.

- Saving money is often perceived as a daunting task, and that mindset can sometimes get in the way of achieving short and long-term goals.

To help our users save and budget more effectively, we decided to build a tool that would let them easily organize their money in the Stash app—and so the foundation for partitions was laid!

The Design and Build Process

Throughout months of design work, we kept listening to our customers. We learned about their needs and took in their suggestions. We designed our first version of partitions based on this feedback, then went right back to our customers and asked if what we’d built met their expectations.

Finally, our engineers and QA team set out to build partitions in a way that’s secure, functional, and scalable.

The Future of Partitions1

We’re not the first to do this, but we are doing it differently. We’re building a feature that works for everyone—from users who prefer more independence and control, to those who desire a little more guidance and assistance.

And we’re still not done! This is just our first iteration of partitions, and we’re really excited about what the future holds. We’d like the feature to evolve to contain:

- Types: We’ll introduce new functionality specific to each of the partition types (for example, goals vs. expenses).

- Customized Guidance: We’re going to start providing recommendations to help you meet your financial goals. This could include check-ins, suggestions, and moments of celebration.

- Automation: We’re working on integrating some of your favorite automatic saving strategies (like Round-Ups and Auto-Stash) into partitions.

- Data: Stash is data-driven, and we want to share our insights with you to help you better manage your spending. You’ll soon be able to opt into the data visualization and insights you need to continue making financial progress.

In the meantime, we want to hear from you! Contact us at ideas@stashinvest.com with feedback.

Disclosures

1. Money moved into a partition must be moved back to available balance to be used and does not earn interest.